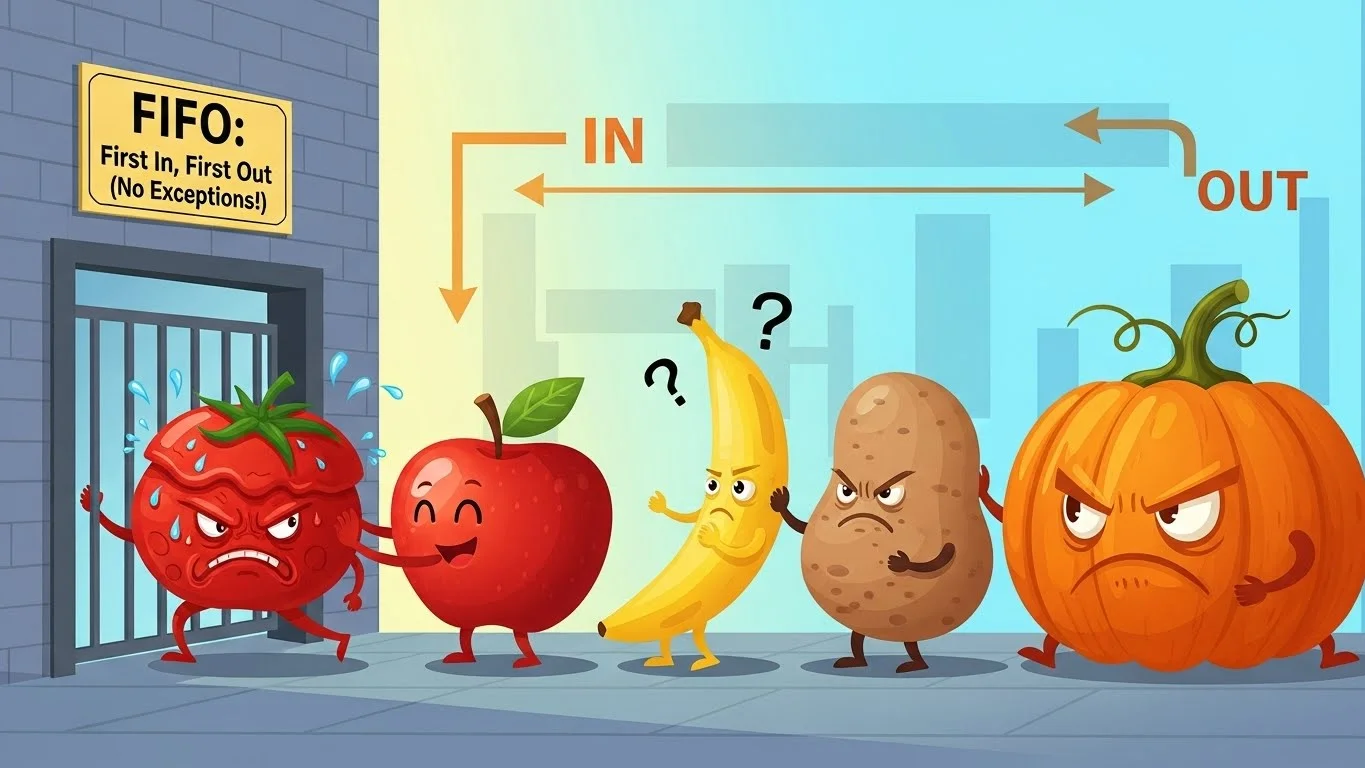

The term “FIFO” is widely used in accounting, inventory management, and computing, but many people are unsure what it actually means. Understanding the FIFO meaning helps students, business owners, and professionals make sense of financial reports, stock handling, and process flow systems.

What Does FIFO Mean in Simple Terms

In simple terms, FIFO means “first in, first out,” where the earliest items added are the first ones used or removed.

FIFO in Accounting

In accounting, FIFO is a method used to value inventory by assuming the oldest stock is sold first.

FIFO in Inventory Management

In inventory systems, FIFO helps ensure older products are used before newer ones to avoid waste.

FIFO in Business

Businesses use FIFO to track stock flow and calculate cost of goods sold accurately.

FIFO in Daily Life

In daily life, FIFO applies to situations like standing in a queue where the first person in line is served first.

FIFO in Warehousing

Warehouses use FIFO to manage storage efficiently and reduce product expiration or damage.

FIFO in Manufacturing

Manufacturers apply FIFO to maintain product quality and consistent production flow.

FIFO Meaning in Retail

Retailers rely on FIFO to rotate stock so older products are sold before newer arrivals.

FIFO in Computing

In computing, FIFO describes data processing where the first data entered is the first processed.

FIFO in Programming

In programming, FIFO is commonly used in queues and buffer management.

FIFO Meaning in Logistics

Logistics operations use FIFO to control shipment order and inventory turnover.

Common Misunderstandings About FIFO

Some think FIFO always increases profits, but its impact depends on pricing and market conditions.

Difference Between FIFO and LIFO

FIFO uses oldest items first, while LIFO uses the most recent items first.

FIFO Meaning Compared to FEFO

FIFO focuses on entry time, while FEFO prioritizes earliest expiration dates.

Advantages of Using FIFO

FIFO improves accuracy, reduces waste, and aligns with natural stock flow.

Disadvantages of FIFO

In some cases, FIFO can increase taxable income during inflation.

FIFO Meaning in Financial Statements

FIFO affects inventory valuation, profit margins, and reported income.

FIFO Meaning in Cost Calculation

Costs are calculated using older prices, often reflecting more realistic inventory value.

When FIFO Is Most Useful

FIFO is ideal for perishable goods, retail stock, and transparent accounting.

Why Understanding FIFO Matters

Understanding the FIFO meaning helps improve inventory control, financial clarity, and decision-making.

Frequently Asked Questions

Q1: What does FIFO mean?

FIFO stands for “first in, first out,” meaning older items are used or sold first.

Q2: Is FIFO used in accounting?

Yes, it’s a common inventory valuation method in accounting.

Q3: How is FIFO used in daily life?

Queues and waiting lines follow the FIFO principle.

Q4: Is FIFO better than LIFO?

It depends on business needs, pricing trends, and regulations.

Q5: Does FIFO increase profits?

Sometimes, especially during inflation, but not always.

Q6: Where is FIFO commonly applied?

In accounting, inventory management, retail, computing, and logistics.

Conclusion

The FIFO meaning centers on the idea that the first items added are the first ones used or removed. From accounting and inventory to computing and everyday life, FIFO provides a logical and fair system for managing flow and order. Understanding FIFO helps improve efficiency, accuracy, and decision-making across many fields.